A health card is a health insurance identity proof that holds your personal details, policy information and financial coverage under a health insurance plan. It offers cashless payment options to pay for your medical bills arising from hospitalisation and other treatment charges. When you present your health insurance card in the hospital, the hospital management will digitally analyse the financial coverage that you can avail to plan for the treatment.

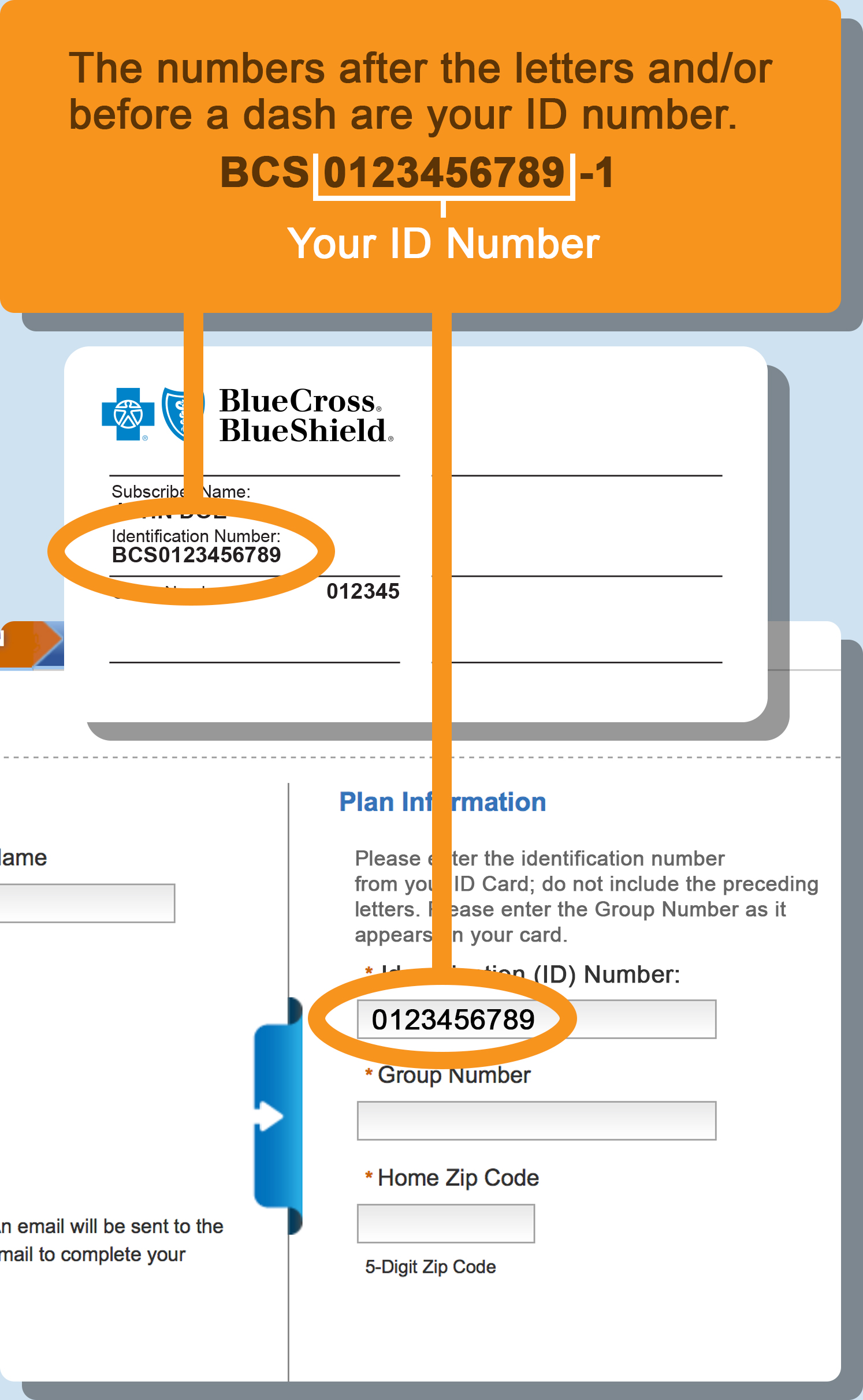

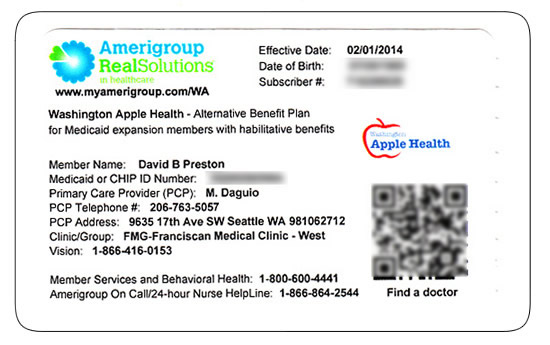

They can also get the expenses paid by the insurance provider directly. Please present your UHCSR student health insurance ID card each time you receive medical services to ensure proper eligibility verification and claims processing. Please be sure that the provider includes your unique 7-digit StudentResources ID number printed on the front of your card when submitting claims or making inquiries regarding your eligibility. You should point out to providers that ALL inquiries regarding coverage, copays and claims MUST be directed to UnitedHealthcare StudentResources , which is a stand-alone division of UHC. The UHCSR Customer Service toll-free number is listed on the front of your ID card and the claims mailing address is listed on the back of your ID card. Each person covered by a health insurance plan has a unique ID number that allows healthcare providers and their staff to verify coverage and arrange payment for services.

It's also the number health insurers use to look up specific members and answer questions about claims and benefits. If you're the policyholder, the last two digits in your number might be 00, while others on the policy might have numbers ending in 01, 02, etc. According to the Pennsylvania Insurance Department, handwritten insurance ID cards are not permitted to be issued by Pennsylvania licensed insurance companies or agents.

You can get access to your health card when you purchase your health insurance plan. The insurance provider will provide the medical insurance card and the policy document at policy issuance. If all your family members are covered under health insurance, every person will receive a separate and unique health card. As long as the issuing agent has no reason to believe the information provided is fraudulent or the insurance agent or vehicle owner falsified the information listed on the ID card.

If you do not see your coverage amounts and co-pays on your health insurance card, call your insurance company . Ask what your coverage amounts and co-pays are, and find out if you have different amounts and co-pays for different doctors and other health care providers. Your health insurance policy number is typically your member ID number. This number is usually located on your health insurance card so it is easily accessible and your health care provider can use it to verify your coverage and eligibility.

Many health insurance cards show the amount you will pay (your out-of-pocket costs) for common visits to your primary care physician , specialists, urgent care, and the emergency department. If you see two numbers, the first is your cost when you see an in-network provider, and the second—usually higher—is your cost when you see an out-of-network provider. For example, when you're referred to a specific specialist or sent to a specific hospital, they may not be in your insurer's network. There are different types and benefits of health insurance plans and extended coverage options. For instance, the Tata AIG health insurance provides pre and post hospitalisation cover.

In order to maintain a record of the treatment undertaken and the extent of financial support rendered by the insurer, a health card becomes essential. The health insurance card can be used in case of hospitalization in any of the network hospitals of the insurance company. This helps the insurance holder to avail the cashless treatments in case of hospitalization.

At the time of hospitalization, the policyholder will be required to present the health card to the hospital authority. The insured can initiate the process of cashless claim and get the claim settled easily and quickly if they have the health insurance card handy and present it upon hospitalization. Students should carry their health insurance identification card with them at all times because an unplanned emergency room visit can occur. Providers always request a copy of your ID card when providing care, including emergency room providers.

If you obtain treatment without your ID card a bill will be sent to you directly. If the bill is not paid within 30 days, many providers will send your name to a collection agency. If you present your ID card to the provider at the time of service, the bill is usually sent to the insurance company, first, for payment. Your car insurance policy number is the unique number your insurance company uses to identify your account. It's written on your insurance card as well as bills and statements you receive from your insurer.

How To Find Policy Number The most common scenarios in which you'll need your policy number are after a car accident, if you're pulled over and any time you want to contact your insurance provider. Finally, you might see a dollar amount, such as $10 or $25. This is usually the amount of your co-payment, or "co-pay." A co-pay is a set amount you pay for a certain type of care or medicine. Some health insurance plans do not have co-pays, but many do. If you see several dollar amounts, they might be for different types of care, such as office visits, specialty care, urgent care, and emergency room care.

If you see 2 different amounts, you might have different co-pays for doctors in your insurance company's network and outside the network. All health insurance cards should have a policy number. When you get a health insurance policy, that policy has a number.

On your card, it is often marked "Policy ID" or "Policy #." The insurance company uses this number to keep track of your medical bills. If you lose your health insurance card with your policy and group number on it, it is important to contact your health insurance company right away and let them know. Call your insurance provider's customer service number and a representative should be able to help you. The insurance ID card is unacceptable as proof of insurance.

If the individual is the sole owner of the company, the issuing agent must see the declaration page of the applicant's insurance policy. If upon review of the policy, the issuing agent determines that other vehicles titled in the company name are covered by that policy, a temporary registration plate may be issued. If no other company vehicles are listed on the applicant's declaration page, temporary registration plate may not be issued using that document as proof of insurance.

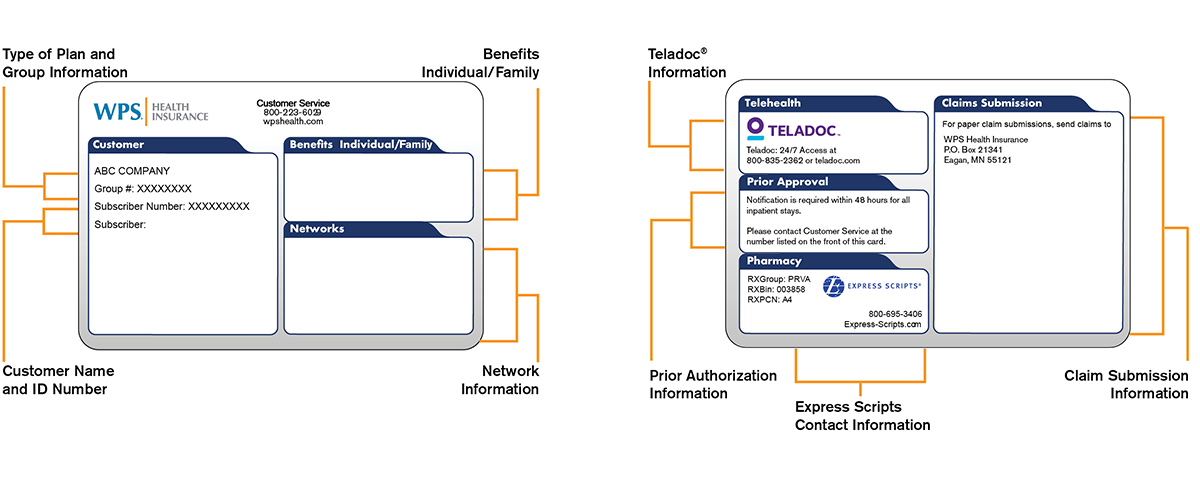

Issuing agents may not telephone insurance agents to verify an applicant's insurance information in lieu of examining an acceptable proof of insurance document. If you have health insurance through work, your insurance card probably has a group plan number. The insurance company uses this number to identify your employer's health insurance policy. Your insurance company may provide out-of-area coverage through a different health care provider network. If so, the name of that network will likely be on your insurance card. This is the network you'll want to seek out if you need access to healthcare while you're away on vacation, or out of town on a business trip.

If you have family members listed as dependents on your health insurance plan, they may each have their own unique policy number as it is used for identification purposes and billing procedures. Your health insurance policy number is what identifies you as a covered individual under your current or previous plans. It's important because if you change jobs or get married, divorced, etc., then your HIPN will need to match the new situation. If you move out of state, your HIPN needs to reflect where you live now. This health insurance card is nothing but a proof or evidence that your health risks are covered.

This card contains your policy number, name of insured, date of birth and policy name with Sum Insured. For health insurance policy holders what matters the most is their health card. Health Insurance card is issued by the insurer to the insured at the time of policy issuance. This is another benefit of having a health insurance card that validates the claim. When the card is presented for the cashless treatments, the hospital cross-checks the policy details, the identity of the policyholder and validates the health insurance policy. Upon finding everything in order, the hospital validates the claim and allows cashless treatment.

This also applies to any critical illness insurance claim filed. A member ID number and group number allow healthcare providers to verify your coverage and file insurance claims for health care services. It also helps UnitedHealthcare advocates answer questions about benefits and claims. As long as the wife currently is in possession of a vehicle and the registration card and the proof of insurance have the same vehicle identification number listed. Otherwise, the issuing agent must request the applicant to present the declaration page of the existing insurance policy to verify coverage for the wife.

If the wife's name is not listed on the declaration policy, a binder of insurance in the wife's name would be required. Prohibits an issuing agent acting as an insurance agent for a licensed insurance company or agency from accepting an electronically transmitted proof of financial responsibility document. Every health insurance company has its toll-free helpline number, which can be used in case of claims or to resolve any queries. However, it is not always possible to remember these numbers. There is an emergency helpline number given on the health card. Thus, the policyholder can quickly call the helpline number and intimate the health insurance claim in case of any medical emergency.

Informing the insurer of the claim is the first step in the process of claim settlement. The insurance companies issue a health card to the policyholder at the time of policy purchase. Although a health card looks the same as a regular debit or credit card it is very useful at the time of claims.

Read this article further to know some important benefits of having a health insurance card. In this day and age, having a health insurance plan is a must for every individual to protect themselves and their family from exorbitant medical costs in case of any medical emergency. With the skyrocketing cost of healthcare in India, it is imperative to have the right coverage to ensure total financial security in case of any eventualities. When you go to an appointment with your health care provider, they will ask you for your insurance information.

Your member ID number and group number allow healthcare providers to verify your coverage and file claims for health care services. These numbers also help UnitedHealthcare advocates answer questions about your benefits and claims. Your health insurance company might pay for some or all the cost of prescription medicines. If so, you might see an Rx symbol on your health insurance card. But not all cards have this symbol, even if your health insurance pays for prescriptions.

Sometimes, the Rx symbol has dollar or percent amounts next to it, showing what you or your insurance company will pay for prescriptions. The back or bottom of your health insurance card usually has contact information for the insurance company, such as a phone number, address, and website. This information is important when you need to check your benefits or get other information.

For example, you might need to call to check your benefits for a certain treatment, send a letter to your insurance company, or find information on the website. The descriptions below apply to most private health insurance ID cards in the United States. If you live outside the U.S. or have government-provided insurance, you may see some different fields on your card. The health card details elaborate on the information related to your health insurance.

For example, it contains your name, policy number, type of health insurance policy, sum insured, date of expiry etc. It is unique to every person and should be maintained carefully for extended usage. A health insurance plan is an insurance product wherein the insurer will provide the necessary financial assistance as and when required to treat any disease, injury or even surgery. The extent of financial support will be based on the sum insured and the health insurance premium amount. Based on the policy terms and conditions, you can avail of the cashless claim or the reimbursement claim according to your preferences. NO. The issuing agent must request written documentation from the insurance company that state the individual owner's vehicle is covered by the business policy.

The written documentation in addition to the insurance ID card, declaration page or binder would be acceptable as proof of insurance. If you enroll in the Standard Plan, Savings Plan, MUSC Plan or Medicare Supplemental Plan, BlueCross provides health insurance cards for you and your covered family members. The health insurance card helps policyholders to initiate the process of cashless claims and get the claim settled easily and quickly. The back of your member ID card includes contact information for providers and pharmacists to submit claims. It also includes the member website and health plan phone number, where you can check benefits, view claims, find a doctor, ask questions and more. You might see another list with 2 different percent amounts.

The "coverage amount" tells you how much of your treatment costs the insurance company will pay. This information might be on the front of your insurance card. It is usually listed by percent, such as 10 percent, 25 percent, or 50 percent. For example, if you see 4 different percent amounts, they could be for office visits, specialty care, urgent care, and emergency room care. Most health insurance cards contain straightforward identification information about the people covered and the policy you have. This communication provides a general description of certain identified insurance or non-insurance benefits provided under one or more of our health benefit plans.

Our health benefit plans have exclusions and limitations and terms under which the coverage may be continued in force or discontinued. For costs and complete details of the coverage, refer to the plan document or call or write Humana, or your Humana insurance agent or broker. In the event of any disagreement between this communication and the plan document, the plan document will control. As against the mediclaim card, you can use the health insurance card to settle all the expenses apart from the hospitalisation charges such as the ambulance cost, OPD expenditures etc. Furthermore, the expiry date is presented on the health card itself and will remain a reminder until you proceed with the renewal process. Health care card online facility is best recommended to get the renewal done at the comfort of staying at your home.

It is assigned to your employer by the insurance company and can also be beneficial for both you and your health care provider in finding out what your coverage entails and submitting claims. If the coverage cannot be extended, the individual must get a new binder for the motorcycle from the insurance agent/broker prior to the issuing agent issuing a motorcycle registration plate. The insurance ID card would be unacceptable as proof of insurance. The issuing agent must request the surviving spouse to present the declaration page of the existing insurance policy or obtain a copy of a binder of insurance in his/her name.

The declaration page of the existing policy may have the surviving spouse's name listed, wherein the issuing agent could transfer the plate. The surviving spouse must contact the insurance agent and make the appropriate changes to the policy. Requires that proof of financial responsibility be verified by issuing agents examining one of the acceptable items listed under Question #1. Therefore, telephone calls to insurance agents for insurance verification purposes may not be made by issuing agents. However, issuing agents may telephone an insurance agent to request that a photocopy, facsimile or printout of an acceptable proof of insurance document be provided.

Once you buy a medical insurance policyfrom HDFC ERGO, the team dispatches policy wordings and documents come along with the health card. Getting health insurance cashless is prominent feature of the health card, hence it is very important to have a health insurance card. Your health insurance policy allows you to enjoy medical services offered by providers included in Harel's agreement, at no cost. Just like the validity up to date mentioned on the credit or debit card, the health insurance card also contains the validity date of the health insurance policy.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.