The public backlash was so severe that the firm had to drop the idea. Nevertheless, all Bank of America checking accounts – Bank of America Core Checking and Bank of America Interest Checking -- require account holders to do something to avoid monthly fees. The basic Core Checking account offers two possibilities of avoiding fees – holders must have at least one qualifying direct deposit of $250+ or maintain an average daily balance of $1,500+.

BofA also waives the fee for students under age 23 who are enrolled in high school, college, university or a vocational program. This straightforward business checking account offers 100 transactions per month at no charge, plus unlimited electronic deposits and up to $5,000 in cash deposits per statement cycle. The $15/month fee drops to $12 when you opt for paperless statements and to $0 when you maintain a $1,500 minimum daily balance or link a Chase private checking account. An account requires a $25 minimum deposit to open, and includes multiple debit cards for employees. You'll have to apply in person for an account, and while Chase has 5,100 branches across 31 states, most are found only in major markets.

With Well Fargo's most basic business bank account, you can make up to 50 transactions per month at no charge and deposit up to $3,000 in cash each month. (Deposits above $3,000 will incur a 30-cent fee per $100.) Although this account has a $10 monthly service fee, you can avoid the cost by maintaining a $500 average balance. With a minimum opening deposit of just $25, this simple business banking solution is excellent for the small business with limited cash-flow activity.

With all Wells Fargo business checking accounts, you can apply in person or online, and send your deposit and required documents later. If you're running a small business that's quickly expanding, an upgrade to this Citizen's account may give you a nice boost. Perks include 500 free check transactions per statement period, $100 off your first order of checks, a 10 percent discount on payroll services, and a business credit card with no annual fee. Combine the balances of your business loans, savings, and money market accounts to help waive monthly maintenance fees. However, you do not have to attend one of the affiliated schools to open a U.S. And there are several appealing reasons to do so, starting with the $0 monthly maintenance fee it offers and the U.S.

Bank ATMs, mobile check deposit, and payments with Zelle. You also get the ATM fee waived for your first four non-U.S. Bank ATM transactions per statement period, and your first order of checks is free. All three checking accounts do offer some ease in saving through two programs.

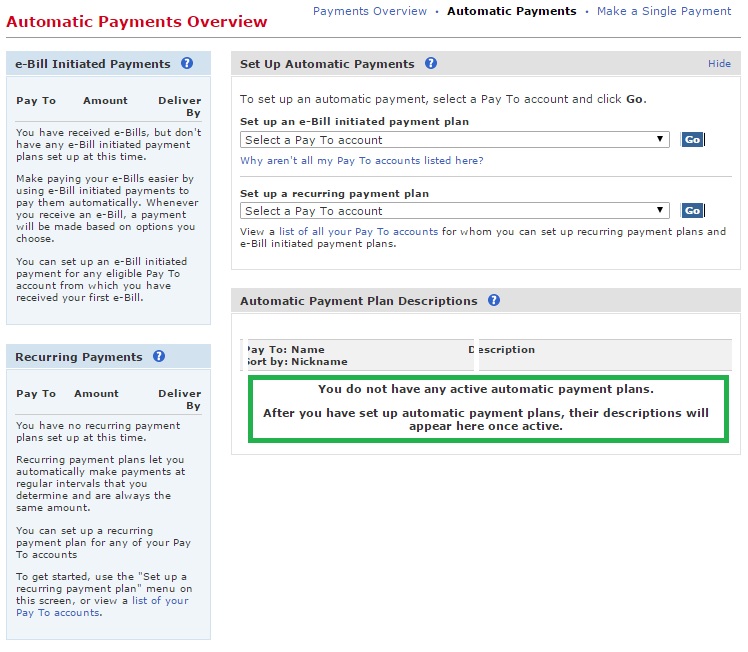

The Keep the Change® program links your checking account to your savings account. When you make purchases with your debit card, Bank of America will round that purchase up to the nearest dollar. You also have access to BankAmeriDeals® which provides cash back deals. When you pay for purchases with your debit or credit card you can earn cash back that is debited to your account by the end of the following month.

You can access both of these programs through Online and Mobile Banking. If your business bank account needs are fairly simple and you require few monthly transactions, this SunTrust account could be a good option. The $5 monthly maintenance fee is waived for the first year, after which you can avoid it when you make at least five debit or credit transactions per month or link a SunTrust personal checking account. The account includes 50 transactions and $2,000 in cash processing per month. SunTrust clearly outlines all stipulations and rules on its site, allows you to apply online, and has some great small-business resources online. The Plus Banking tier of this BoA program includes everything SafeBalance Banking does, only it adds in paper check availability and overdraft protection.

Again, this is not an interest-bearing account, and a minimum initial deposit of $100 is required to open it. The monthly maintenance fee for this account is also higher, as it starts at $12. "Keep the Change" is a convenient savings program that rounds your every debit card purchase up to the nearest dollar and deposits the rounded amount into your linked Bank of America savings account.

However, it is important to be aware that BofA charges monthly fees for savings and checking accounts. Fees can be avoided with some conditions; otherwise, monthly charges will dramatically decrease savings. Take a look at the comparison of major U.S. bank savings accounts below. Not only BofA is well behind CIT Bank in interest rates but also has fees that some other banks do not charge.

The bank's checking account earns 1% cash back on up to $3,000 of qualifying debit card purchases each month. The savings account pays a competitive rate and Discover offers a suite of other products and services. With just $100 required to open an account, you'll also get free online bill pay for up to 15 payments per month.

Applying online or in person with a minimum opening deposit is just $25 for this account—that's a terrific value with great flexibility for growing businesses. For most small businesses, a business checking account is essential. Opening one will allow you to pay invoices, bills, and employees from your business account; receive payments ; withdraw cash; and more. Since you'll want to start with opening a business checking account first, the information below is focused on helping you find the best checking account for your small business. But if you have even a small cash reserve, there's value in opening a savings account, too.

A savings account can boost your business credit, earn interest, and help you maintain minimum balance requirements. Bank of America is converting all eBanking accounts into its Core Checking product, which includes a $12 monthly fee. There are a few ways consumers can avoid the $12 monthly maintenance fee.

The first way to avoid the fee is to have a qualifying direct deposit of at least $250. The second is to maintain a minimum daily balance of $1,500 or more. The third is to prove the you are a student younger than 24. If you don't need the assistance of a customer service representative, you can easily manage and access your money online or on the bank's mobile app. You can deposit checks on the app by taking a picture of both sides of the check. You can transfer money, pay bills, locate ATMs and branches and receive customized alerts on your mobile app, as well.

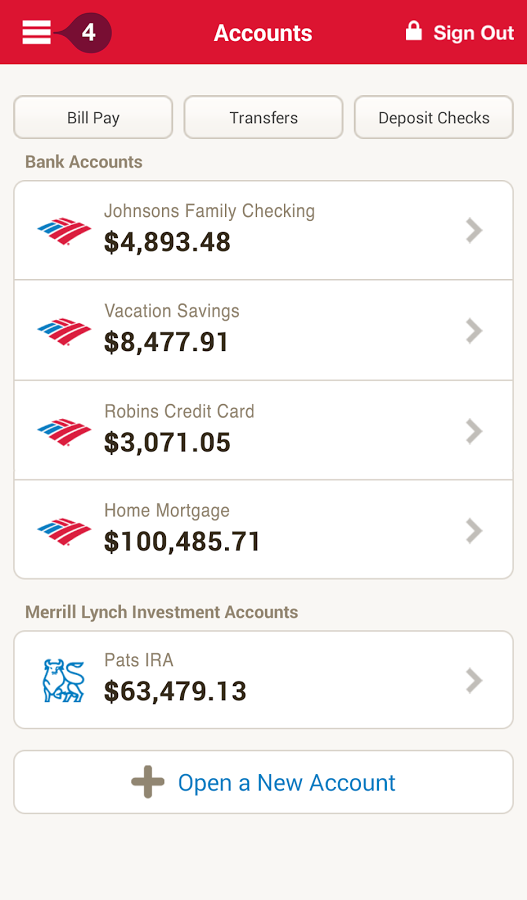

You can see your checking account balances, your transactions and other balances. SafeBalance Banking is the lowest tier, which means it comes with the least features. For example, while account holders will be able to take advantage of a free debit card and Zelle® money transfers, paper checks and overdraft protection are not included. However, because this account is fairly basic, it comes with the lowest monthly maintenance fee, which is $4.95.

This fee can be waived if you're enrolled in BoA's Preferred Rewards program or you're a student under the age of 24 that's currently enrolled in school. Open a new Business Advantage Checking or Business Fundamentals Checking account and make qualifying deposits of $20,000 or more in new money within 15 days of account opening. Maintain an average daily balance of $20,000 during the maintenance period and make five qualifying electronic payments that are posted to the new checking account by the end of the maintenance period. The maintenance period begins 16 calendar days after account opening and ends 75 calendar days after account opening. Offer only available to customers who receive offer via a direct communication from a Bank of America® small business specialist or from a Bank of America communication. Open a new Business Advantage Checking or Business Fundamentals Checking account and make qualifying deposits of $5,000 or more in new money within 15 days of account opening.

Maintain an average daily balance of $5,000 during the maintenance period and make five qualifying electronic payments that are posted to the new checking account by the end of the maintenance period. Downsides include a $2 fee for non-Popular ATMs, which only exist regionally—a potential dealbreaker for frequent business travelers. This BofA account is great for the growing small business. You can apply online, but note that Bank of America outlets don't exist everywhere; branches in the South and Midwest are sparse.

Lastly, the Relationship Banking tier is the only BoA checking account that earns interest. However, the account's rates are quite low, as all balances less than $50,000 receive just a 0.01% APY and all balances of $50,000 and up receive an equally unimpressive 0.02% APY. Otherwise, this account also calls for a $100 minimum opening deposit, and its features are the same as the Plus Banking tier. The monthly fee is much higher than the aforementioned mid-tier account, though, as it starts at $25 per month.

To waive this charge, you can enroll in the Preferred Rewards program or maintain a combined balance of $10,000 across all of your eligible linked accounts. 6Send Money with Zelle® is available for most personal checking and money market accounts. To use Send Money with Zelle® you must have an Online Banking profile with a U.S. address, a unique U.S. mobile phone number and an active unique e-mail address. Your eligible personal deposit account must be active and enabled for ACH transactions and Online Banking transfers.

To send money for delivery that arrives typically within minutes, a TD Bank Visa® Debit Card is required. Message and data rates may apply, check with your wireless carrier. Must have a bank account in the U.S. to use Send Money with Zelle®.

Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license. Navy Federal Credit Union comes out on top for bank accounts. There are no or low monthly maintenance fees, and you can have unlimited signers on your account. It's a great deal for smaller startups or sole proprietors.

Designed for small businesses with moderate account activity, Axos charges no monthly maintenance fees and offers unlimited domestic ATM fee reimbursements. You'll get your first set of 50 checks free, QuickBooks compatibility, 200 free combined transactions per month , and free bill pay. For a low-fuss account, the minimum opening deposit is comparatively higher than some banks on this list at $1,000. With this PNC business bank account, there's no charge for up to 500 combined transactions per month. With more opportunities to offset monthly account maintenance fee than the company's Business Checking account, Business Checking Plus also offers cash-flow insight and analysis at no charge. You can also earn cash back with PNC's rewards program, and the bank's Quick Switch Kit makes it easy to switch banks.

Though many banks entice customers with "free" banking, as always, you'll need to read the fine print. While business banking accounts typically have higher fees than personal accounts, some banks offer checking accounts with no monthly fees. However, often account holders are required to keep a minimum daily or monthly balance, or can only make a limited number of transactions to avoid incurring a fee. Free or low-cost accounts do exist; just be sure to choose wisely. Monthly service fees are fees that banks charge on a monthly basis to maintain your bank account, and are usually between US$6 and $50 per month, depending on the bank and the type of account you open.

For example, they are often waived as a benefit of student bank accounts and can also often be avoided by having a regular monthly deposit or keeping a certain amount of money in your bank account. Make sure you check your chosen bank to verify their policy on monthly service fees. The bank does offer an opportunity to snag deals and save money with its BankAmeriDeals® program. It provides cash back deals when you pay for purchases with your debit or credit card.

The cash back is then debited to your account by the end of the following month. Plus, your mobile app shows you exactly where you can earn these rewards with an interactive map tool. You can also access the program through your online account. Confusion can arise, however, because banks use different methods to calculate whether and when you have met the minimum balance. Be sure to ask the bank how and when they calculate their minimum balance requirements, including what constitutes a statement cycle, before deciding to open your account. Also, be sure to ask if there are other ways to avoid incurring fees after you stop being an eligible student, such as using online banking or setting up direct deposit.

Generally, Bank5 Connect offers a winning combination of attractive rates and low minimum deposit requirements across its products. It requires only $10 to open a savings or checking account and a relatively easy-to-meet $500 minimum deposit requirement to open a CD. There are no monthly maintenance fees on any of its accounts. Enrollment with Zelle through Wells Fargo Online® or Wells Fargo Business Online® is required.

Available to almost anyone with a U.S.-based bank account. For your protection, Zelle should only be used for sending money to friends, family, or others you trust. The Request feature within Zelle is only available through Wells Fargo using a smartphone, and may not be available for use with all small business accounts at this time.

In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle. Neither Wells Fargo nor Zelle offers a protection program for authorized payments made with Zelle. To send money to or receive money from an eligible small business, a consumer must be enrolled with Zelle through their financial institution. Small businesses are not able to enroll in the Zelle app, and cannot receive payments from consumers enrolled in the Zelle app.

For more information, view the Zelle® Transfer Service Addendum to Wells Fargo's Online Access Agreement. You can receive monthly direct deposits of at least $250 or maintain a minimum daily account balance of at least $1,500, among other options. First Internet Bank is an online-only bank that offers checking accounts, savings accounts, a money market account, and CDs with attractive yields. As one of the original online banks, it knows a thing or two about providing great service sans branches. You'll also get a free detailed analysis of your account activity.

Visit a branch, call, or mail in your completed application to open an account, with just $50 as an opening deposit. Designed for digital entrepreneurs who want access to hassle-free, integrated tools, an online-only account with Azlo allows you to send and receive unlimited domestic payments entirely fee-free. (International payments are on the way.) Azlo integrates with Stripe and Square seamlessly and plans to connect with Etsy, Paypal, QuickBooks, and Xero next. Partnered with Compass Bank, Azlo offers FDIC backing and all the relevant security. You may transfer funds between personal checking, savings and money market accounts. You may also transfer funds from a personal deposit account to a Commerce personal loan, credit card or ReadyLine of Credit to make a payment.

In addition, you may transfer funds from a Home Equity Line of Credit to a personal deposit account. ¹ Transfers require enrollment and must be made from a Bank of America consumer checking or savings account to a domestic bank account or debit card. Recipients have 14 days to register to receive money or the transfer will be canceled. That's not as bad as some of Bank of America's checking accounts, but you'd need to keep several hundred thousand dollars in this savings account in order to earn enough interest to offset the monthly fee.